Responding to customers’ financial data management needs, G-Accon’s newest release, Custom Accounting Reports for Xero, streamlines financial reporting. This enhancement offers accountants superior customization. Coupled with G-Accon’s recognition among G2’s Best Accounting & Finance Software Products in 2024, let’s find out how to refine the development of accounting workflows.

Simplify Financial Data With a 2024 G2 Leader

Joining powerhouses like Xero and Sage Intacct, G-Accon has made it into G2’s 2024 Best Accounting & Finance Software Products. Our software has secured a coveted 20th position among leading accounting solutions. Being the absolute front-runner of Google Workspace for Finance, this acknowledgment is a nod to our efforts to provide time-saving integrations for professionals across the financial industry.

Here’s an invitation to revisit one of our recent blog posts for a deeper dive into our latest achievements, detailed in the G2 Winter 2024 Reports. Uncover the whole story and the nuances of our recent success at G-Accon’s Winter G2 Awards.

Enhanced Accounting Precision With Xero Custom Reports

This Custom Accounting Reports upgrade significantly strengthens users’ abilities to push forward financial reporting and analysis capabilities. These reports are a toolkit for businesses engaged in international transactions or those looking to segment their data for refined financial management.

An invaluable collection of reports, it delivers a granular outlook of financial obligations and assets. Specifically, it facilitates sophisticated payables and receivables management and strategic planning of cash flows and collections efforts. Let’s have an overview of how this suite works.

Note: you must be logged into Xero to use these features.

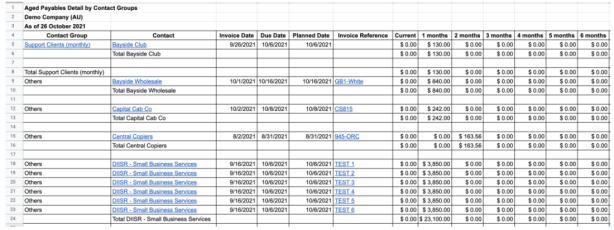

Aged Payables Detail by Contact Groups

It provides users with comprehensive information about aged payables organized by contact groups. Also, it facilitates a more precise understanding and management of payables related to different contact groups or suppliers.

To generate the accounting report from Xero, select G-Accon for Xero > Get Accounting Data/Reports > Custom Reports > Aged Payables Detail by Contact Groups.

When exported to Google Sheets via G-Accon for Xero, it offers customizable financial oversight by contact groups. You’ll benefit from having automatic data refreshes and extensive report customization.

Aged Payables Detail in the Customer Currency

This report delivers insights into aged payables using the customer’s currency, which is particularly useful for businesses involved in international transactions and multiple currencies.

Similar to the rest of our extensions, follow these steps to generate your report: Select G-Accon for Xero > Get Accounting Data/Reports > Custom Reports > Aged Payables Detail in the Customer Currency.

Users can gain from various adjustments, including

- Google Sheets Export: export the Aged Payables Detail report in the customer’s currency to Google Sheets.

- Customizable Templates: adjust date ranges (Dynamic, Static, Custom via cell reference) and choose specific attributes for tailored report generation.

- Enhanced Pull Settings: using advanced settings to initiate new sheets, integrate report titles, enable deep linking to Xero, and refine how information is displayed and organized.

- Automated Refresh Scheduling: set up workflows to automate data updates and send notifications, promoting data oversight within spreadsheets.

- Template and Report Adjustments: modify templates and reports through the “Edit Templates” feature for ongoing adaptability.

These tools highlight benefits like improved customization, scheduled updates, and streamlined data handling via G-Accon for Xero.

Aged Receivables Detail in the Customer Currency

Like the aged payables report, this report displays aged receivables in the customer’s currency. It enables better receivables management in a multi-currency context.

In line with our existing extensions, you can follow this route to generate your report: select G-Accon for Xero > Get Accounting Data/Reports > Custom Reports > Aged Receivables Detail in the Customer Currency.

Key features include the “Change Pull Settings” for report customization, such as formatting options, data table creation, and linking directly to Xero. It also facilitates setting up automated data refreshes and notifications through workflows, offering great flexibility in your reporting.

Aged Receivables Detail by Contact Groups

This feature details outstanding receivables by customer or client groups or categories. Overall, it simplifies the management and organization of collection efforts to sustain a healthy cash flow. Businesses need to categorize their accounts receivable information for optimized receivables management.

As with our other extensions, choose G-Accon for Xero > Get Accounting Data/Reports > Custom Reports > Aged Receivables Detail by Contact Groups to use this feature.

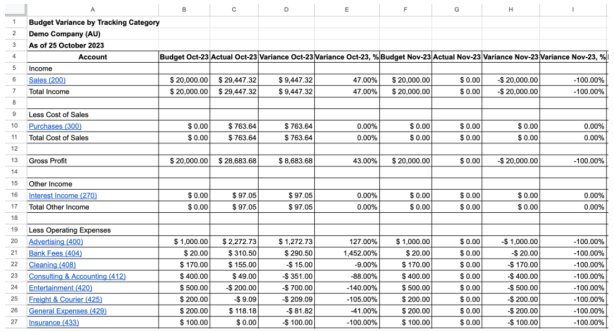

Budget Variance by Tracking Category

This analysis contrasts planned budgets with actual expenses, sorted by tracking categories. It aids in monitoring compliance with budgetary adherence while pinpointing areas with discrepancies.

Following our other tools’ procedure, head to G-Accon for Xero > Get Accounting Data/Reports > Custom Reports > Budget Variance by Tracking Category to create your report.

Budget vs. Actuals by Tracking Category

It compares budgeted amounts with actual expenditures, segmented by tracking categories. It supports an in-depth evaluation of budgetary performance across various business segments.

Consistent with our suite of extensions, access your report by going to G-Accon for Xero > Get Accounting Data/Reports > Custom Reports > Budget vs Actual by Tracking Category.

This integration enhances automated workflows and streamlines data management while ensuring current updates. Extensive customization options facilitate polished presentations and empower actionable financial insights.

A robust package through and through, these reports’ functionalities bolster the reporting and analytical features of G-Accon for Xero. They excel at equipping users with a set of tools for effective financial data management and comprehension.

Watch our latest video on new custom accounting reports for QuickBooks and Xero in our G-Accon Integration channel:

Find the complete list of G-Accon for Xero reports here

- Budget Variance by Tracking Category

- Budget vs. Actual by Tracking Category

- Xero Aged Payables Detail by Contact Groups

- Xero Aged Payables Detail in the Customer Currency

- Xero Aged Payables Summary by Contact Groups

- Xero Aged Payables Summary in the Customer Currency

- Xero Aged Payables Summary

- Xero Aged Receivables Detail by Contact Groups

- Xero Aged Receivables Detail in the Customer Currency

- Xero Aged Receivables Summary

- Xero Aged Receivables Summary by Contact Groups

- Xero Aged Receivables Summary in the Customer Currency

Cash Transactions and Project Profitability Summary for QBO

Sharpen your business’s financial edge now and gain some data-driven insight with these two features only released for Quickbooks.

G-Accon’s Cash Transactions Report for QuickBooks boosts reporting efficiency by directly linking to Google Sheets. Users can now generate Profit and Loss reports with a comparison feature, which enables a side-by-side analysis of different classes or categories. Readily customizable for your business needs, it’ll ensure precise transaction tracking. It’s the accountant’s tool for deep cash flow insights, driving smart, timely decisions.

The Project Profitability Summary reshapes reporting by offering clear profitability insights. It enables quick strategy shifts with solid data comparisons over time. Tailored to your reporting needs, you’ll gain critical profitability insights for strategic moves. This feature will allow your business to understand financial trends comprehensively, cementing more informed business decisions based on historical performance.

Key Takeaways from G-Accon’s Reporting Enhancements

You can have the right insights with our versatile reporting solutions on cash transactions, project profitability summaries, aged receivables, and more. Stay ahead of the competition with

- Cash Flow Analysis: tracking every cash movement with Cash Transactions Reports and enabling a deeper look into your business’s liquidity.

- Profitability Insights on Projects: evaluating each project’s financial health with the Project Profitability Summary and providing an understanding of where to allocate resources for maximum return.

- Tailored Reporting: setting specific time frames and business needs with dynamic, static, or custom date ranges. Your data will always be relevant.

- Data Management: automated workflows and direct Google Sheets integration simplify report updates and share the latest data.

- Multi-Currency Capabilities: comprehensive financial analysis across borders without the hassle, thanks to multi-currency conversion features.

- Actionable Financial Insights: detailed parameters and required attributes facilitating strategic operational adjustments.

By harnessing the full potential of these integrated reports, accountants can implement business strategies that are agile and aligned with their financial goals.

Confide in our expertise by accessing G-Accon’s software today. Let us continue providing you with the best financial automation solutions.

Try G-Accon today and learn how to set your financial reporting apart by streamlining your processes with automated efficiency.

Any questions? Let us know your suggestions by shooting an email to support@accon.services.

This is financial clarity made easy. This is G-Accon.