Wondering if you could handle all your financial statements in one place? Say hello to our new add-on to accelerate your manual consolidation hassles. These consolidated reports for QuickBooks provide finance professionals with streamlined insights—all within the intuitive interface of G-Accon for Google Sheets.

Maintaining steady accuracy across multiple financial reports can feel like an uphill battle. Traditional consolidating reports also means fighting complexity and compliance. These will only take you so far. Add juggling business data between different platforms to the mix, and you have the potential for financial data-led mayhem.

This is your call to access actionable input on your financial data with a unified reporting view. Gain control over your business’s financial landscape with G-Accon Consolidated Reports: an all-in-one consolidation reporting suite with a complete view of a corporate group’s financial performance. Investors, creditors, and stakeholders can use consolidated reports to optimize financial dynamics and focus on strategic financial decision-making.

Why You Need Consolidated Reports for Your Financial Insights

Most of the time, financial professionals weather the demanding, complex finance landscape with ease. But as corporate needs evolve, so does the importance of meeting new financial requirements. Don’t let inaccurate reporting slow you down and trap you in poor reporting performance.

G-Accon Consolidated Reports for QuickBooks in Google Sheets comes to your rescue with an army of reports enhancing efficiency across the board. At its core, it offers streamlined consolidation of financial reports from various sources, including QuickBooks, into a single framework.

By consolidating reports, financial teams eliminate the need for cross-referencing multiple documents, leading to faster report generation. Be aware this efficiency does not come at the expense of detail. G-Accon’s automation processes are tailored to each business’s needs and provide customized insights. Need more reasons? Just get a grasp of these time-saving features:

- Real-time data access and compilation with reporting capabilities, ensuring financial aspects are thoroughly analyzed.

- Automated consolidation of reports for QuickBooks to allocate more time to strategic tasks.

- Reducing human-led errors associated with efficient manual data entry, enabling accurate intercompany transactions.

- Intuitive reporting interface, both user-friendly and straightforward.

- Catering your business needs with simplified compliance by tailoring multi-currency and multi-entities global operations.

Opting for G-Accon’s QuickBooks integration for consolidated reporting means using all-embracing automated reports to simplify your compliance in financial consolidation and handling intercompany transactions with high precision. Curious to know more about these report’s capabilities? Let’s examine each of them.

Two-Tier Consolidated Reporting Approach to Simplify Finances

G-Accon’s consolidated reporting for QuickBooks users caters to corporations’ high-demanding accounting needs. To balance overall and detailed insights into individual entities, enjoy a dual reporting approach with two categories, each serving distinct strategic functions. Experience this combined formula for unmatched financial mastery.

For a comprehensive financial snapshot, take advantage of our overview consolidated reports, critical to reveal trends. These reports are designed to gain a deeper understanding of the business’s overall financial health and include:

- Consolidated Profit and Loss Report: This report aggregates income and expenses across all your QuickBooks accounts. This overview is essential for strategic planning and performance evaluation.

- Consolidated Balance Sheet Report: Providing a snapshot of the company’s financial position. It aggregates data across all entities to deliver a unified view of assets, liabilities, and equity. Suitable for businesses operating on multiple fronts, this report simplifies complex financial landscapes into actionable intel.

- Consolidated Cash Flow Report: Helps you better understand cash flow. By merging cash flow data from multiple QuickBooks accounts, this report provides a clear picture of how cash moves in and out of your business. Managing liquidity and investing in growth has never been easier.

Enter company-specific insights with high-detailed analysis with the entity-level performance reports. Find precision reporting for your business with:

- Consolidated Profit and Loss by Company Report: By breaking down profits and losses on a company-by-company basis, this report drives targeted improvements and fosters growth in specific areas of your business.

- Consolidated Balance Sheet by Company Report: This report allows for an in-depth examination of each entity under your umbrella. An invaluable resource for enabling precise financial management, it’ll dissect the financial health of individual companies within a larger conglomerate.

- Consolidated Cash Flow by Company Report: Offering a detailed analysis, it indicates where cash is being generated and used. It is a closer look at the operational efficiency of individual companies.

Take advantage of this competitive add-on. Make every business decision an opportunity to maximize reporting potential and navigate your business financial journey with great confidence.

Watch our quick video tutorial on how to generate new Consolidated Reports.

Tailored Insights With Consolidated Reporting by G-Accon

G-Accon not only addresses the common pain points faced by finance professionals but also leverages technology to empower businesses with clarity and strategic insights. With these features, you can transform your approach to financial management.

Customized Reports Selection

Select and customize reports to focus on your business strategy. Learn to access actionable insights, facilitating more informed decisions:

- Achieve reports with optional customizable modifications, such as creating a structured data table based on the retrieved information or adding a “Company Name Column” for company names to the data structure.

- Obtain a straightforward workflow setup, ensuring stakeholders have the latest information without manual intervention or much fuss.

- Reflect changes or updates in reporting requirements easily, enhancing team collaboration and saving time.

- Go for optional report behavior customization includes preserving original data formatting, generating new worksheets, freezing data table headers for ease of viewing, and more.

This reporting selection supports your business and financial stability by reducing financial consolidation times and complexities.

Enhanced Data With Attributes

Propel data accuracy on your reports, reducing the risk of errors and enhancing trust in your financial data. When adapting attributes, you aid your data strategy in categorizing and analyzing financial data more efficiently. There are required and optional attributes with the ability to set up your data with:

- Dynamic, Static, and Custom Date Range selection by choosing from pre-populated values or pinpointing specific start and end dates. Create a tailor-made date selection in Google Sheets for report generation.

- Opt to preserve the original formatting of the data being pulled.

- Maintain a standardized structure by retrieving headers to include and display column names associated with the data.

- Reflect consistent visibility when entering a new worksheet or tab within Google Sheets and freezing elements such as the “Data Table Header.”

- Apply organized input integrating a “Company Name Column” for company names into the data structure.

- Incorporate the new data into pre-existing templates with the “Append to the Previous Templates” feature.

- Enhance reporting legibility with a specific formatting style to alternate rows.

Don’t wait; try this integration today to determine its many benefits.

Simplified Multi-Currency System

Handling multi-currency transactions is essential for businesses operating in the global market. This integration will save valuable time. Automate conversions and consolidation of multi-currency transactions and invest this precious time in other decisive operations. Benefit from generating custom multi-currency reporting featuring:

- Work with the latest exchange rates using the latest rates, providing flexibility for global operations.

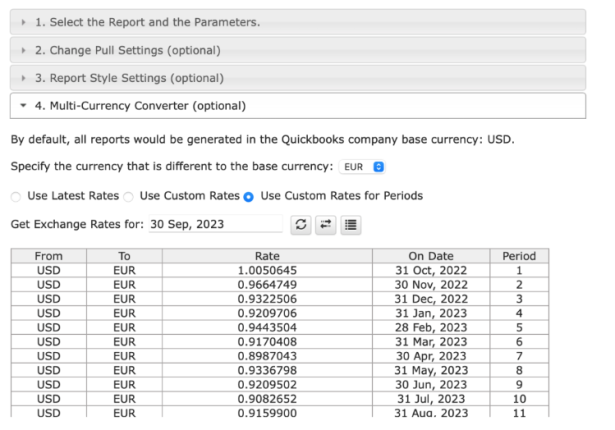

- Decide how to get exchange rates according to your needs:

- Latest Rates: Uses the latest available exchange rate.

- Custom Rates: Set your exchange rates for a specific date or create a separate tab with multiple custom rates.

- Custom Rates for Periods: Set custom rates for specific periods similarly.

The Efficiency of Automated Workflows

Reduce the time spent on data entry and consolidation, allowing more room for compliance. With automated consolidation, you get up-to-date data outflow, simplifying the compliance process. Automated data refreshes ensure ongoing data gathering reliability. Refer to the “Create Workflow” documentation here for more specific details.

By integrating these four key features into your financial reporting processes, G-Accon aims to leverage your business technology to empower your growth with strategic insights.

Choose Optimized Accounting Efficiency With G-Accon Consolidated Reports

This set of features presents a solution that caters to the changing financial needs of modern accounting practices. Incorporating this consolidated reporting with G-Accon can evaporate complexity and clarify your strategic decisions with a unified data management approach.

Don’t let manual consolidations drain your productivity and stop your struggle to maintain accuracy across multiple reports with our consolidated reports for QuickBooks solution. Embrace financial mastery with:

- Automated reporting with integrated data compilation and analysis to allocate more time to strategic tasks.

- Performance optimization by reducing human-led errors associated with manual data entry.

- User-friendly reporting interface, both intuitive and straightforward.

- Empowered decision-making backed up by high-level and entity-level insights.

- Simplified consolidation with accurate outputs.

- Collecting real-time actionable data for comprehensive and detailed financial analysis.

- Equipping financial teams to share relevant findings to impact the company’s financial health.

Try G-Accon today to drive targeted financial management improvements and foster the growth of your business.

Email us at support@accon.services. Your contributions are highly valued as we strive to improve our services for users.

This is financial clarity made easy. This is G-Accon.